The financial markets in the Middle East have experienced rapid growth over the past decade, and the United Arab Emirates (UAE) has emerged as a global hub for trading, investment, and financial innovation. At the heart of this ecosystem lies a crucial component: liquidity. A reliable liquidity provider in the UAE ensures smooth trade execution, competitive pricing, and stable market conditions. Bright Gate stands out as a trusted name, delivering professional liquidity solutions to brokers, institutions, and traders across the region.

Understanding Liquidity and Its Importance

Liquidity refers to the ease with which financial assets can be bought or sold in the market without causing significant price changes. High liquidity means tighter spreads, faster execution, and minimal slippage—key factors for successful trading.

In markets with low liquidity, traders face delayed execution, price manipulation risks, and higher transaction costs. This is why partnering with a strong liquidity provider UAE is essential for brokers and financial institutions operating in competitive global markets.

What Is a Liquidity Provider?

A liquidity provider (LP) is a financial entity that supplies continuous buy and sell prices for financial instruments such as forex pairs, commodities, indices, cryptocurrencies, and CFDs. Liquidity providers maintain deep liquidity pools and ensure that trades are executed efficiently, even during volatile market conditions.

Bright Gate, as a professional liquidity provider in the UAE, connects clients to global financial markets by offering deep liquidity, advanced technology, and transparent pricing models.

Bright Gate – A Trusted Liquidity Provider in the UAE

Bright Gate is a UAE-based liquidity provider offering institutional-grade liquidity solutions tailored to modern trading environments. With a focus on reliability, transparency, and performance, Bright Gate supports brokers, hedge funds, proprietary trading firms, and financial institutions.

By leveraging advanced infrastructure and strategic partnerships, Bright Gate ensures uninterrupted market access and competitive pricing across multiple asset classes.

Key Strengths of Bright Gate

Deep multi-asset liquidity

Ultra-fast execution speeds

Tight spreads and low latency

Scalable solutions for growing brokers

Compliance-focused operations

These strengths position Bright Gate as a preferred liquidity provider UAE for businesses seeking stability and long-term growth.

Liquidity Solutions Offered by Bright Gate

Bright Gate provides a comprehensive range of liquidity services designed to meet the needs of both retail and institutional clients.

Forex Liquidity

Bright Gate delivers deep forex liquidity across major, minor, and exotic currency pairs. This enables brokers to offer competitive spreads and reliable execution to their clients.

CFD and Multi-Asset Liquidity

From indices and commodities to metals and cryptocurrencies, Bright Gate supplies diversified liquidity that supports multi-asset trading platforms.

Institutional Liquidity

For hedge funds and professional traders, Bright Gate offers customized liquidity solutions with high volume capacity and advanced risk management.

Prime-of-Prime Liquidity

Bright Gate acts as a prime-of-prime liquidity provider, giving brokers access to top-tier liquidity sources without the need for direct bank relationships.

How Bright Gate Operates

Bright Gate operates using advanced aggregation technology that combines liquidity from multiple Tier-1 banks and financial institutions. This aggregated liquidity is streamed directly to clients through ECN and STP execution models.

Trades are executed automatically with minimal latency, ensuring fair pricing and reduced slippage. Bright Gate’s technology-driven approach guarantees seamless order processing, even during high market volatility.

Benefits of Choosing Bright Gate as Your Liquidity Provider UAE

Partnering with Bright Gate offers several strategic advantages:

Tighter Spreads

Aggregated liquidity ensures highly competitive spreads, improving profitability for brokers and traders.

Fast Execution

Low-latency infrastructure allows near-instant trade execution, critical for high-frequency and algorithmic trading.

Reduced Risk

Deep liquidity minimizes order rejection and slippage, protecting clients during volatile market movements.

Scalable Infrastructure

Bright Gate’s solutions grow with your business, making it ideal for startups and established brokers alike.

Transparent Pricing

No hidden fees or price manipulation—Bright Gate emphasizes clarity and trust.

Regulatory Environment in the UAE

The UAE has built a strong regulatory framework that promotes transparency and investor protection. Liquidity providers operating in the region must adhere to strict compliance standards set by regulatory authorities.

Bright Gate aligns its operations with UAE financial regulations and global best practices, ensuring secure and compliant liquidity solutions for its clients.

Why the UAE Is Ideal for Liquidity Providers

Several factors make the UAE an attractive destination for liquidity providers:

Strategic location connecting Asia, Europe, and Africa

Advanced financial hubs such as DIFC and ADGM

Business-friendly regulatory environment

Growing demand for forex and CFD trading

Strong technological infrastructure

As a UAE-based company, Bright Gate leverages these advantages to deliver world-class liquidity services.

Challenges in Liquidity Provision and How Bright Gate Solves Them

Liquidity provision comes with challenges such as market volatility, technological demands, and risk exposure. Bright Gate addresses these challenges through:

Real-time risk monitoring systems

Advanced pricing engines

Robust server infrastructure

Continuous liquidity optimization

This proactive approach ensures stability, even during extreme market conditions.

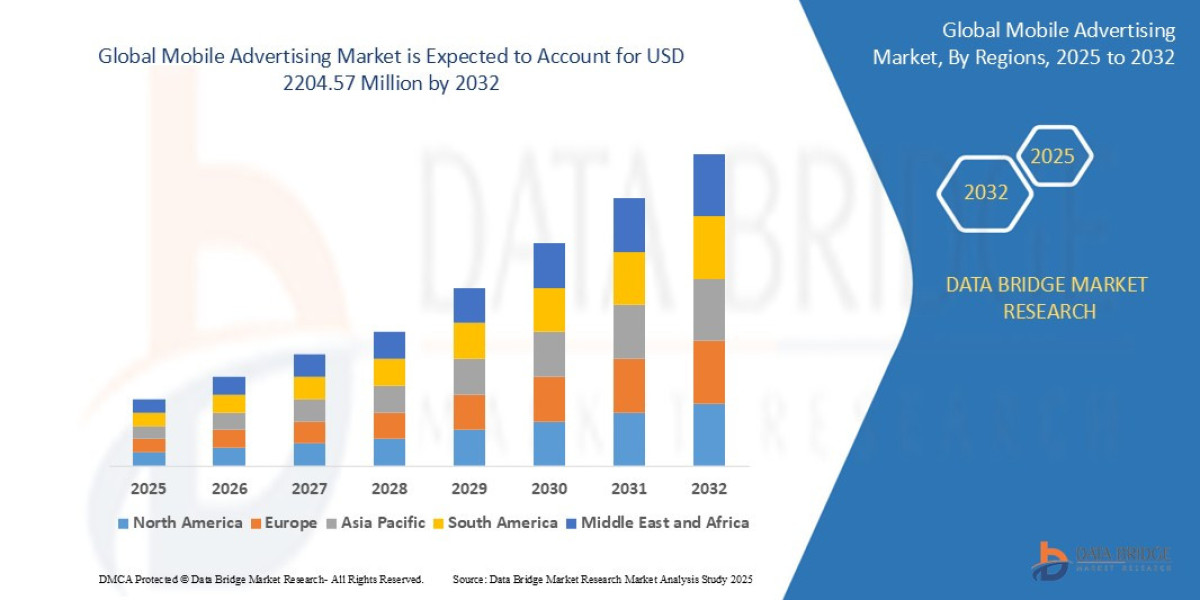

The Future of Liquidity Providers in the UAE

As financial markets continue to evolve, the role of liquidity providers will become even more critical. Innovations such as AI-powered trading, blockchain settlements, and digital assets are reshaping liquidity management.

Bright Gate remains at the forefront of this evolution, investing in technology and innovation to meet future market demands. With a strong vision and client-centric approach, Bright Gate is well-positioned to lead the next generation of liquidity providers in the UAE.

Conclusion

Choosing the right liquidity provider UAE is essential for achieving trading efficiency, stability, and growth. Bright Gate offers a powerful combination of deep liquidity, cutting-edge technology, transparent pricing, and regulatory alignment.

Whether you are a broker launching a new platform or an institution seeking reliable market access, Bright Gate delivers liquidity solutions you can trust. With its commitment to excellence and innovation, Bright Gate continues to set new standards in liquidity provision across the UAE and beyond.